Cot Forex

The commodity futures trading commission (commission or cftc) publishes the commitments of traders (cot) reports to help the public understand market dynamics. A complete guide to understanding cot data for forex trading.

Swing Trading Commodities With The COT Forex Ask

Swing Trading Commodities With The COT Forex Ask

There are two main types of traders in a cot report:

Cot forex. But with the cot report, forex traders can have an insight into these pieces of info. The cot data is an important and versatile tool for forex trading. The commitment of traders (cot) reports show futures traders’ positions at the close of (usually) tuesday’s trading session.

Since cftc releases the weekly report every. Cot report as a forex volume indicator. However, it is useful to use other fundamental analysis data to measure the validity of market volume.

The cot report or commitment of traders report is provided by the commodity futures trading commission (cftc) and is an excellent tool for forex and commodity traders to analyse what other participants are doing in the market. The commitments of traders (cot) is a weekly report released by the commodity futures trading commission (cftc). Just by using the cot as an indicator, you could have caught two crazy moves from october 2008 to january 2009 and november 2009 to march 2010.

Using cotindi by sym it's easy. Commitments of traders (cot) charts the cot report is a breakdown of each tuesday’s open interest in the major futures markets as reported by the us commodity futures trading commission (cftc). For this reason, some traders use the cot report also for fx although in the report itself nothing is written about the forex market.

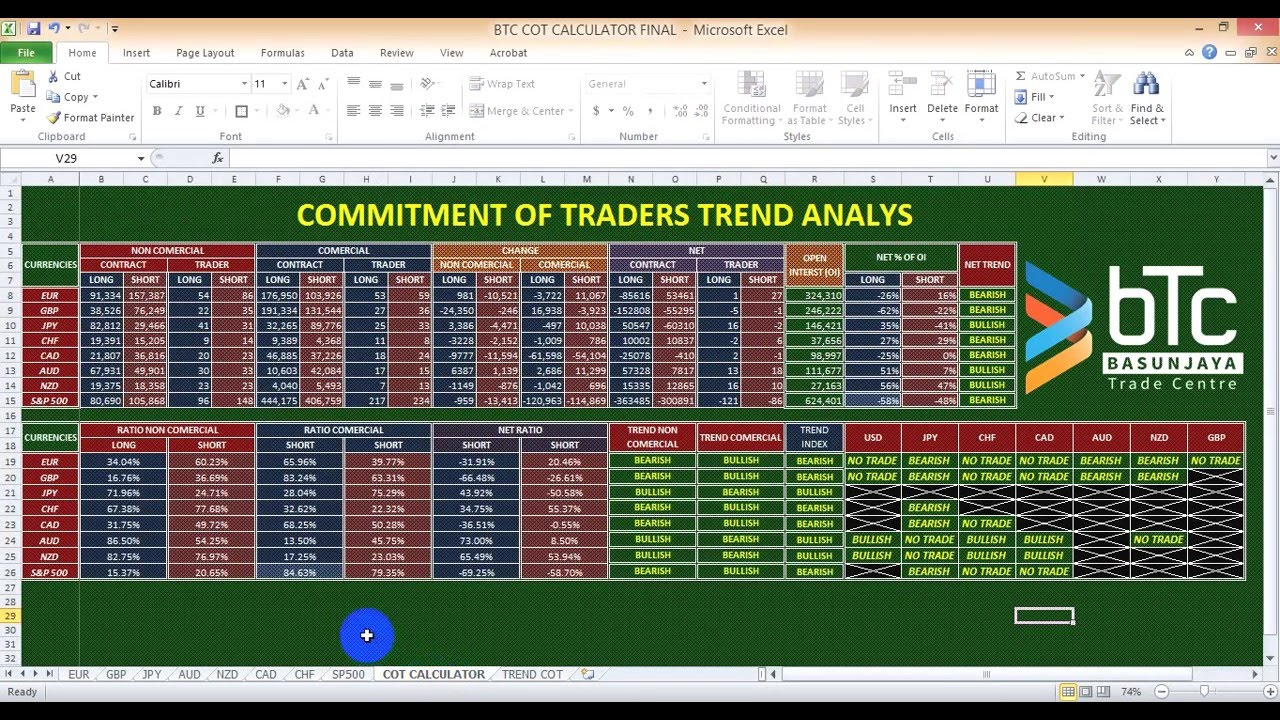

In this article you can learn how to analyze the cot data, a weekly released report with a breakdown of aggregate positions held by three different types of forex traders. They're partially explained in the readme file but i'll explain here as well. The cot report can serve as a powerful forex volume indicator when you use it rightly.

The cot report is published using data from chicago and new york futures exchanges every friday at 14.30 est and is split between three groups; Without a central exchange, keeping track of futures data provides an excellent opportunity to track flows and if you. The commitments of traders report (the cot report) is a weekly sentiment indicator that tracks and provides forex traders with important information on the positioning of currency pairs.

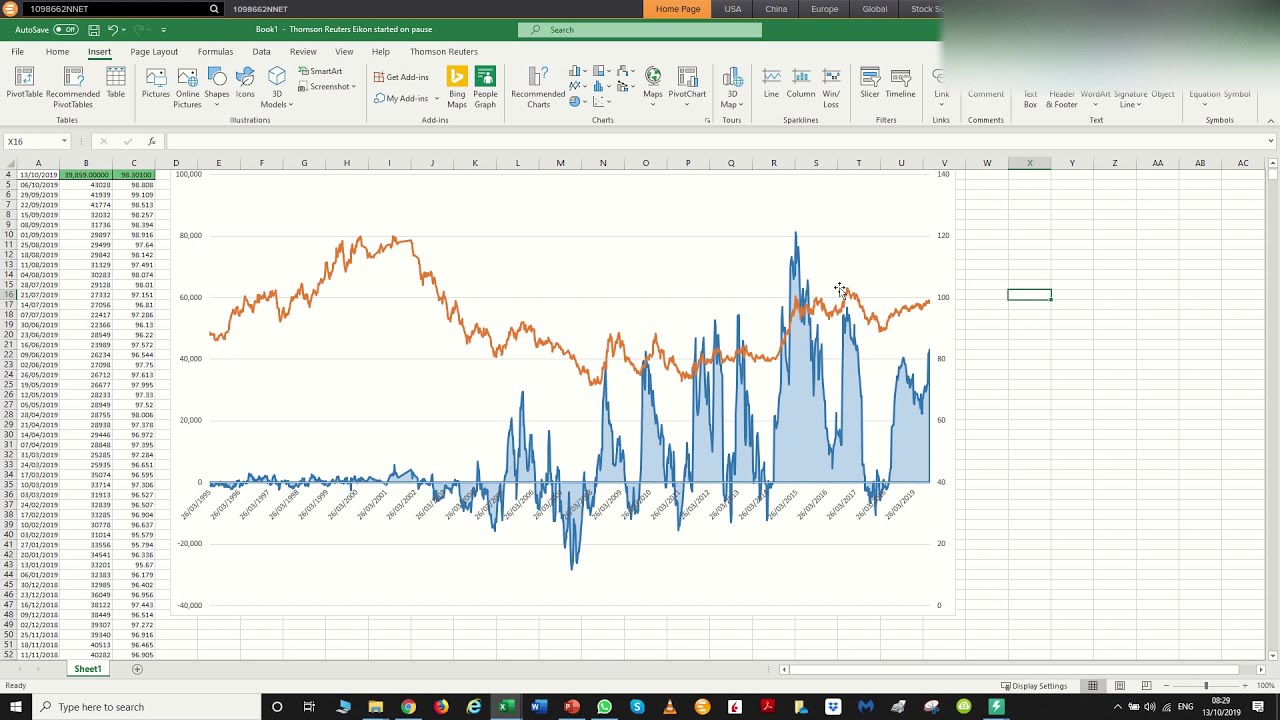

The chart above can be used to view the cftc (commodity futures trading commission) commitments of traders data (or cot in short) in an easily readable format. I hope that has become a bit clearer now. Which brings us to the first use of the cot report in the forex.

The cot report is considered to be an indicator that analyzes market sentiment. If you had seen that speculative traders’ short positions were at extreme levels, you could have bought eur/usd at around 1.2300. In our case, the cot index is 93,88%, respectively, in the picture below, in addition to the changes of the absolute value of open interest i have reflected changes in long position of operators regarding the same value (comm long / open interest).

If the cot index is below 20%: Cot reports provide a breakdown of each tuesday’s open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the cftc. Proper explanations for why i included some of these are found in these 2 books [the commitments of traders bible by stephen briese, trade stocks and commodities with the insiders by larry william's]the first 6 that you listed are simply a stochastic calculation using the net position of the selected group compared.

Forex.com is a registered fcm and rfed with the cftc and member of the national futures association (nfa # 0339826). The commitments of traders (cot) reports are provided by the commodity futures trading commission (cftc). The only main indicator entry is:

Cot is a weekly report released every friday at 3:30 am est by the cftc listing current contract commitments (including currency futures contracts) for the prior tuesday. Let us see another example: Forex profits with cot report.

The most important thing is to understand that there are no easy forex profits with the cot report. The commodity futures trading commission, or cftc, publishes the commitment of traders report (cot) every friday, around 2:30 pm est. Max and min opened long positions (from 2006 till today, the.

Open interest percent = commercial short / open interest. The data is published by the cftc every week on friday and contains an aggregated report of the different holdings of market participants in the us futures market (where you can trade. The numbers under dealer are red colored, this means the line chart below is drawn by these numbers in the upper side of section 2 (see picture 1) there are:

The cot report outlines how different types of traders are positioned in the futures markets. Free cot data should not be construed by any consumer as a solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice over the internet. The data is divided into three categories:

Free cot data does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any. Because the cot measures the net long and short positions taken by speculative traders and commercial traders, it is a great resource to gauge how heavily these market players are positioned in the market. Specifically, the cot reports provide a breakdown of each tuesday’s open interest for.

Actually, the cot is a volume indicator, as well. It lets traders know if the market is with or against them. The cot report is a weekly sentiment report that can provide forex traders with important information on the positioning of currency pairs.issued by the commodities futures trading commission.

The report is prepared by the commodity futures trading commission (cftc). The charts between forex and futures market are almost identical. Commitments of traders (cot) reports descriptions.

Cftc (us commodity futures trading commission) provide a weekly report on market positioning among groups of traders called the commitments of traders (cot) report.

CFTC COT Forex Positioning No More Dollar Domination

CFTC COT Forex Positioning No More Dollar Domination

How to Use the COT Report for Trading Forex

How to Use the COT Report for Trading Forex

COT report and Forex Trading. YouTube

COT report and Forex Trading. YouTube

Weekly CFTC COT Forex Positioning Weak Greenback Demand

Weekly CFTC COT Forex Positioning Weak Greenback Demand

Weekly CFTC COT Forex Positioning Euro in Play

Weekly CFTC COT Forex Positioning Euro in Play

Forex Cot Indicator Mt4 Free Download Forex Day Trading Bot

Forex Cot Indicator Mt4 Free Download Forex Day Trading Bot

Forex cot trading system harvey norman easter trading

CFTC COT Forex Positioning Update Aug 5th, 2014

CFTC COT Forex Positioning Update Aug 5th, 2014

CFTC COT Forex Positioning Update Aug 5th, 2014

CFTC COT Forex Positioning Update Aug 5th, 2014

Using the COT Report in Forex Trading

Using the COT Report in Forex Trading

Forex Cot Data Forex Trading What Is It

Forex Cot Data Forex Trading What Is It

Weekly CFTC COT Forex Positioning Greenback Bulls on the

Weekly CFTC COT Forex Positioning Greenback Bulls on the

Forex cot report analysis How to use & Trade with COT

Forex cot report analysis How to use & Trade with COT

Automate Forex COT Report Data YouTube

Automate Forex COT Report Data YouTube

What Forex Indicator Shows Cot

What Forex Indicator Shows Cot

Forex Market Preview (COT) 4.5.2019 YouTube

Forex Market Preview (COT) 4.5.2019 YouTube

Weekly CFTC COT Forex Positioning Another Round of

Weekly CFTC COT Forex Positioning Another Round of

Comments

Post a Comment